Recent Storm Damage Posts

Flooding Versus Storm Damage: 3 Differences

4/4/2022 (Permalink)

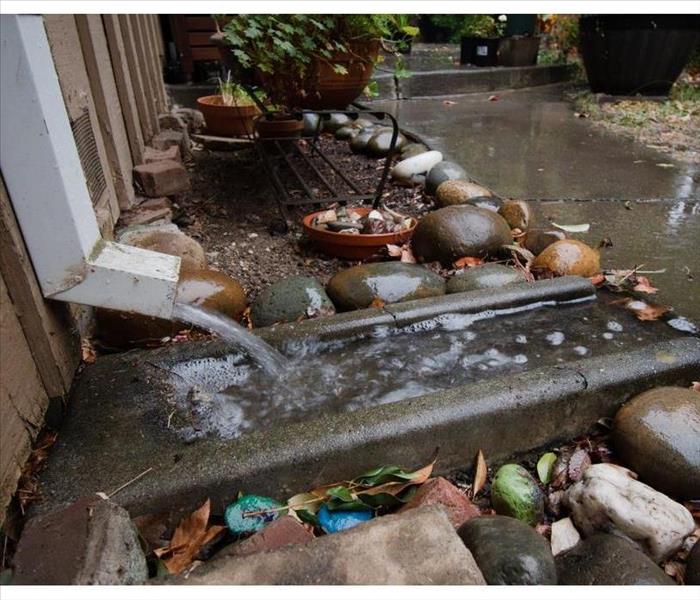

Commercial storm damage in Plymouth Meeting, PA.

Commercial storm damage in Plymouth Meeting, PA.

Three Differences Between Flooding and Storm Damage

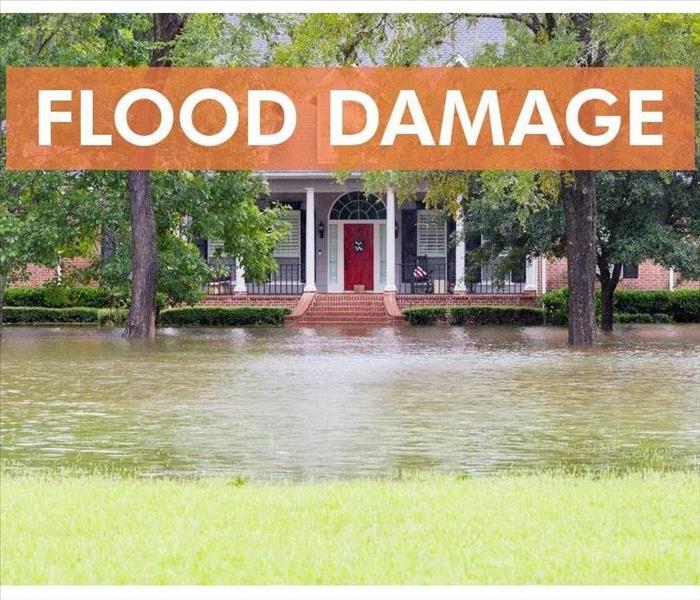

When you own a Plymouth Meeting, PA, business, the risk of storm and flooding damage may be high on your list of worries, especially when certain times of the year are known for violent weather. Storms may produce flooding, high winds and power outages; however, there are several differences between flood damage and other types of issues that result from storms, and understanding each may help you recover more quickly afterward.

1. Floods Contain Black Water

When flooding occurs at your business due to storms, the resulting influx of water is likely to come from a contaminated source, such as an overflowing creek or sewer. As a result, the porous building materials inside your business, such as drywall, may absorb this dirty water and cause stains and an unpleasant odor. You may have to replace such items.

2. Storm Damage Is More Varied

When storm damage occurs, it may be more varied and extended than flooding. High winds can break windows, tear away building materials and cause damage to your property's roof. When these types of problems occur, your storm repair and restoration service may have to spend more time ensuring all types of damage are repaired before you can reopen your business.

3. Insurance Differences

Some insurance companies define flood damage differently than that caused by storms, especially when the flooding came from an internal source, such as a broken pipe. Flooding caused by heavy rains may be covered under your policy; however, it is best to contact your local insurance representative and send photos of the damage before attempting to open a claim. You can protect damaged areas of your building by blocking broken windows with wood planks and using tarps to prevent rainwater from entering a damaged roof.

Flood damage and storms can severely affect your Plymouth Meeting, PA, business in a variety of ways. Understanding how each might impact your bottom line may help you put you on the path to reopening more quickly and reducing downtime for your employees.

What To Keep and What To Toss After a Flood

1/13/2022 (Permalink)

Flood damage a wall in a Flourtown, PA home.

Flood damage a wall in a Flourtown, PA home.

Content Cleaning After a Flood

After flooding, homeowners are faced with the hard labor of cleaning and drying out their homes. When those homes are affected by black water, that hard work often includes tearing out walls, discarding carpeting, and tossing many furnishings and belongings. Fortunately, a content cleaning service from a Flourtown, PA, flood remediation company may be able to save some of the most precious items.

Items You Can Clean on Your Own

For those belongings that haven't been contaminated, you can use the following steps from FEMA for salvaging your valuables:

- Set aside those things that are most important to you.

- Let items gently air-dry, handling them as little as possible.

- Carefully remove dirt and debris with soft brushes or cloths.

- Rinse and air-dry photographs.

- Freeze any items that you can get to within 48 hours. This protects books and documents from further damage.

After flood waters have fully receded, it's time to get everything dried out as quickly as possible. Remove wet items from the home, and document the damage while you work with a camera or cell phone.

Belongings That Should Be Discarded

At this point, many homeowners either want to chuck everything or save everything. Neither option is appropriate. Some items must be thrown out. These include composite flooring, particle board furniture, and any furnishings with signs of mildew. Upholstered furniture is often cheaper to replace than to recover. The same is true for mattresses.

Many of your valuables can be saved by professional content cleaning services. For example, if you have silver, contact a qualified restorer. If you have framed art, expensive rugs, or solid-wood furniture, the pieces can be saved if you get them out of the water quickly enough. Contact the appropriate professionals for help in your restoration efforts. Photographs, books, documents, and family heirlooms are usually worth the cost of hiring professionals.

Content cleaning efforts are a vital resource for homeowners who've experienced flooding. Separate out belongings to be discarded, those that can be saved by your own efforts, and those that require the work of professionals for the most successful flood recovery.

3 Ways To Prepare Your Business for Flood Damage

11/23/2021 (Permalink)

It's important to have flood insurance.

It's important to have flood insurance.

Prepare Your Business for Flood Damage

Flooding can cause your business in Cheltenham, PA, to sustain major damage, and the cleanup process can be expensive and lengthy. However, preparing your business for flood damage can help your business return to normal quickly after a flood.

1. Protect Valuable Items

When floods occur, they often occur without warning, giving you little time to move items in your business. Items that are left unprotected could be badly damaged or destroyed as a result of black water, or water that is contaminated with potentially hazardous bacteria. Keeping valuable documents and other items in higher areas within your building can protect them from water damage. Additionally, you should store your most valuable items in water-resistant containers.

2. Back Up Essential Data

Data helps a business run smoothly, and without necessary data, your business can face time-consuming setbacks. Since you may not have a chance to back up all of your data as soon as you hear about the possibility of a flood, it’s best to routinely save your data and make backups. There are various ways in which you can backup data by using cloud services or external hard drives. Having multiple places to store your data is best, in case one form of backup happens to fail.

3. Purchase Flood Insurance

To ensure your business can recover financially from the effects of a flood, it’s important to have flood insurance. Many insurance companies do not cover the costs of flooding, and it’s important to check your business’s policy to know what will and will not be covered in the event of a flood. If you already have flood insurance, make sure to renew it when needed.

Preparing your business for the impacts of flooding can offer you peace of mind and can save you money and time. In addition to taking preventative steps, make sure to contact the experts in flood damage restoration so your business can open its doors as soon as possible.

How to Protect Your Rented Building from Flood Damage and Loss

8/10/2021 (Permalink)

Drying equipment in Lafayette Hill, PA.

Drying equipment in Lafayette Hill, PA.

How to Prevent Flood Damage and Loss in Your Rented Building

If you rent a building in Lafayette Hill, PA, for commercial purposes, you may be preparing to take out renter’s insurance to protect your inventory and other belongings. One instance you may want to protect yourself from is flood damage, as floods can cause considerable damage to a building and its contents. However, before you sign off on a policy, it is important to understand what is covered, what the property owner is responsible for and the steps you can take to ensure you have the type of coverage you desire.

Know Your Responsibilities

When you rent a building to house your business, understanding your insurance responsibilities can be vital, whether you are renting one floor or the entire structure. When it comes to flood insurance, it is typically your responsibility to insure whatever you bring into the building. This includes any store inventory, machinery or electronic equipment. It is a good idea to go over each item with your insurance agent so you are guaranteed coverage in case of a flood.

Understand the Property Owner’s Insurance Requirements

When it comes to flood insurance coverage, your building’s owner is largely responsible for the structure itself. This means that he or she must provide coverage for whatever space you rent and cover repairs as well. You may want to ask the owner if they have a storm cleanup and restoration company on retainer for the removal of black water or mold that occurs after a flood.

Protect Your Business With Forethought

While renter’s insurance can protect you from the damage a flood can cause, you can also take steps to guard your business beforehand as well. Store important documents on a cloud service or back them up on a device you keep elsewhere. Avoid storing boxed records on the ground floor or pay to have them stored offsite.

Renting a building in Lafayette Hill, PA, for business purposes can be convenient and affordable. However, knowing what renter’s insurance you need before you sign off on a lease can help protect your investment from being lost in a flood.

Take These Steps to Minimize Flood Damage

7/26/2021 (Permalink)

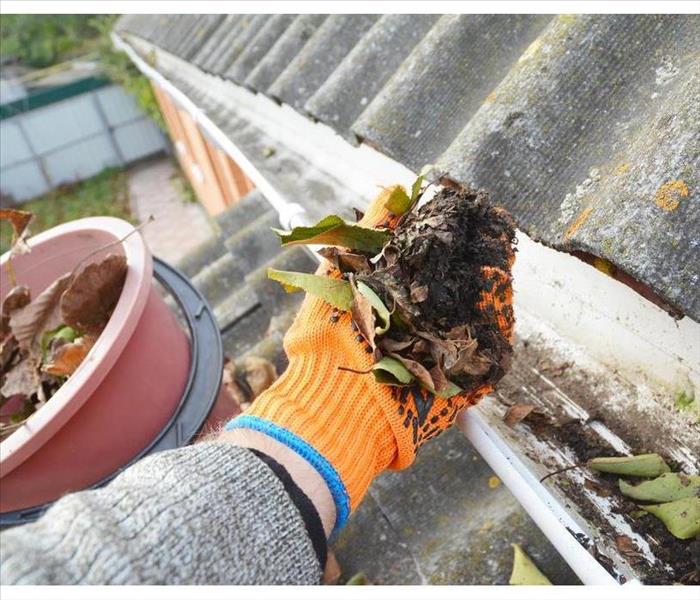

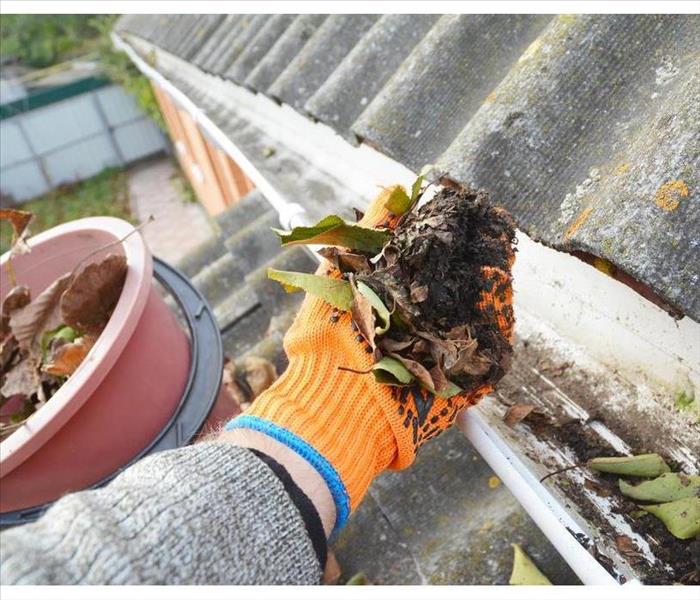

It is important to check your rain gutters once a year.

It is important to check your rain gutters once a year.

Minimize Flood Damage by Following These Steps

Do you worry every time a storm rolls through Wyndmoor, PA, that water will get into your home? Do you think you’ve prepared your property for incoming floodwater? If you’re not sure, it’s time to evaluate your storm preparation plans and ensure you’ve got things ready to keep water out and avoid damage. There are a few things all homeowners should do today to protect their homes.

Secure Your Valuable Belongings

While you should be most concerned about your loved ones and about your home itself, water damage can wreak havoc with your most treasured keepsakes and possessions. There are some things you simply can’t replace, so you need to find methods to keep them out of harm’s way.

- Place treasured materials in waterproof containers.

- Keep important documents such as insurance policies, tax information and mortgage papers in a safe deposit box.

- Take inventory of your precious keepsakes by taking photos.

Clean the Gutters

It’s important to get on your roof once a year (or more frequently if necessary) and check your rain gutters. If they are full of debris, you need to clear them immediately so when major storms come through Wyndmoor, PA, floodwater doesn’t gather around your foundation. Make sure the gutters are sending water far from your home.

Seal Vents and Lower-Level Windows

If you have vents that lead from the outside into your basement, you should seal them to prevent water from entering. A flooded building usually has problems start in the basement, so make sure there are no entry points for water in these areas of your home. Also, double-check your windows that they are secure and free of cracks or gaps.

Flood water can be devastating to your home and possessions. If you want to reduce your risk, you need to put these protective measures in place today. When you do this, you can have the confidence that you’ll be safe when a large storm drops significant precipitation.

Why Commercial Insurance Can Be a Lifesaver for your Company

5/12/2021 (Permalink)

Commercial storm damage in Lafayette Hill, PA.

Commercial storm damage in Lafayette Hill, PA.

Business And Commercial Insurance

Powerful storms sweep through parts of the country nearly every day. They cause multiple billions of dollars to companies in the U.S. every year. A business that does not have robust storm insurance is at a much greater risk of failure than other businesses. The impacts of storms are many and far-reaching:

- Extensive damage to property

- A business interruption

- A potential loss of income

- Added costs and expenses

- Harm to employees and customers

Just one bad storm is enough to cost a company many thousands of dollars. Proper insurance coverage will pay many of the expenses caused by storm damage. This will enable a company to restore and rebuild damaged property.

What Storm Insurance Covers

Every insurance policy is a little different, but a comprehensive policy typically covers damage from storms and fires. Polices are normally structured in a way to have deductibles that must first be paid before insurance payments kick in. Larger deductibles tend to reduce the overall cost of the premiums. Here are some examples of what a comprehensive insurance policy will cover:

- Roof damage caused by high winds

- Hail damage as the result of large hailstones

- Wind damage that breaks windows or doors

- Water damage from roof leaks

In general, so long as the damage from a storm is not caused by the failure of a company to maintain its property, many expenses will be paid through the claims process. In a big storm, this can add up to a large amount.

How Restoration Services Help

While proper insurance coverage will pay for many types of damage, a company will still need the services of a local storm restoration company in Lafayette Hill, PA. These experts will arrive on the scene after a storm and restore the building to its original condition. Storm insurance is one of the main foundations of a strong business. It pays the way for a fast and successful recovery.

What Is Business Interruption Insurance?

4/8/2021 (Permalink)

Drying equipment in Wyncote, PA.

Drying equipment in Wyncote, PA.

Running a business is tough when you don't have the right insurance. A coverage option that business owners must have is interruption insurance. This is designed to help cover income loss while you rebuild your livelihood.

What Does It Cover?

Unlike property insurance, this will not cover costs associated with your rebuild in Wyncote, PA. Instead, it will cover operating expenses, such as:

- Revenue

- Mortgage, rent, or lease payments

- Loan payments

- Taxes

- Payroll

- Relocation costs

- Extra expenses

- Training costs

What Is a Restoration Period?

Your restoration period is the time that you can receive benefits from your interruption policy. Generally, it takes two or three days for your period to start. Typically, it lasts long enough for you to rebuild your business.

How Much Coverage Do You Need?

Every policy has a specified coverage limit. The limit is the maximum amount of money you can receive from filing a claim. Unlike property insurance, which covers undetermined costs like hiring a storm remediation company, interruption coverage is easier to calculate. You can calculate appropriate coverage based on your regular gross earnings. Keep in mind that any costs going over your policy limit will need to be paid for by you, so it is better to estimate growth rather than be left without funds.

What Does It Cost?

Each policy has a unique cost. Typically, it depends on your industry, employee numbers, and the coverage you need.

What Are the Exclusions?

This type of insurance is designed to support the income of a closed business. It does not cover damaged items, flood damage, undocumented income, utilities, and communicable disease-related shutdowns.

If a disaster happens, business interruption insurance can protect you and your company. It is a good way for small businesses to protect themself financially. It does this by offering a source of income when a business is shut down. However, it does not cover any damage directly related to a disaster.

3 Things To Know About Mold Damage After a Flood

1/12/2021 (Permalink)

Mold can grow anywhere

Mold can grow anywhere

Mold After Flood

One of the reasons that flooding can cause such devastating damage to a home is that damage, such as mold growth, often continues to occur long after the floodwater has receded. These are three things you should know about mold after a flood.

1. Mold Begins To Grow Rapidly

Mold spores naturally occur in the air and are already present in your home. Mold grows rapidly in the moist conditions created by standing water. It may begin to multiply in 24 to 48 hours after floodwaters enter your home. Because the mold will continue to grow rapidly as long as damp conditions exist, it is important to dry your property out as soon as possible. A water mitigation company in Cheltenham, PA, can assist you with this process.

2. You Can Take Steps To Prevent Mold

As soon as it is safe to enter your home after a flood, open windows and doors to provide ventilation and help dry out the property. Remove all wet items and debris. Clean hard surfaces with disinfectant or sanitizer. Discard porous materials that may have mold growth. Dispose of the carpet if you can. If you can not, use a wet/dry vacuum or carpet extractor to remove moisture. Use fans to increase air circulation. Run dehumidifiers to reduce the amount of moisture in the air.

3. Mold Can Grow on Your Contents

Mold isn't just a problem for wet furniture, carpets, and walls. It can grow on anything in your house. Dispose of any food that has gotten wet. Not only is wet food likely to mold, but it may also contain harmful bacteria. Wash and sanitize your clothing, children's toys, and other personal items.

Mold growth is one of the many problems caused by flooding that can damage your home. These three tips can help you prevent or slow growth and avoid unnecessary damage.

What is Business Interruption Insurance?

12/26/2020 (Permalink)

Business interruption insurance can help your company stay afloat during an expensive rebuild

Business interruption insurance can help your company stay afloat during an expensive rebuild

There are a lot of moving parts to worry about when it comes to purchasing insurance for your company in Flourtown, PA. One policy that many business owners tend to overlook is business interruption insurance. This type of coverage helps cover your losses while you rebuild after your commercial building suffers massive amounts of property damage.

What Does Business Interruption Insurance Cover?

Business insurance is extremely handy when a covered loss forces your company to close down temporarily. It covers operating expenses such as:

- Relocation costs, if applicable

- Taxes, both monthly and quarterly

- Rent, lease, and mortgage payments for your commercial building

- Employee salaries

- Any necessary loan payments

- The revenue you'd normally take in if your business was open

It's important to remember that these types of policies only cover operating expenses. They do not reimburse you for the actual damages, as those are listed under separate policies. Interruption insurance also does not reimburse you for utilities during the rebuild, as there's no reason to have electricity, water or gas running in a building that no one is using.

How Much Does the Insurance Policy Cost?

There are several factors that contribute to how much you'd personally pay for your closed business insurance. These include which industry you work in, the amount of employees you have, your building's location and the amount of coverage you actually want. Buildings that are located in areas that are more prone to natural disasters, such as hurricanes or wildfires, might have to pay more than companies that are located in places that are less danger prone. Talk to your insurance agent to see which types of policies you can acquire and how much you would have to pay for them.

Don't let expensive property damages destroy your company. Business interruption insurance can help your company stay afloat during an expensive rebuild. In the meantime, contact remediation experts for assistance resolving any property damages your commercial building may have suffered.

4 Tips To Get the Most Out of Your Storm Shutters

10/20/2020 (Permalink)

Storm shutters are a smart way to protect your home and family from damage

Storm shutters are a smart way to protect your home and family from damage

Here Are Some Tips To Ensure That Your Shutters Will Be Up To The Task

Storm season means high winds and heavy rains. Storm shutters are a smart way to protect your home and family from damage and minimize storm cleanup, but they’re only effective if they’re in good working order and correctly deployed before a storm hits.

1. Do a Trial Run

Practice securing your shutters completely at the beginning of each storm season. This is the best way to get a feel for how long it will take you to install them when a storm is on the way. By doing a full test run, you can also be sure that you have all the tools, hardware and equipment you will need.

2. Protect Your Hands and Feet

Aluminum shutter slats have dangerously sharp edges, so wear heavy gloves when handling them. Don’t be tempted to carry a stack of panels, as one might fall and cut your foot or leg. Long pants and closed-toe shoes are smart choices.

3. Leave Yourself Plenty of Time

Allow yourself more time than you think you’ll need to install the storm panels when a storm is approaching. If your trial run took three hours, for example, give yourself five hours. You may have time to install your shutters once a storm “warning” is issued for Whitemarsh, PA. However, high winds can be unpredictable, so it’s a good idea to go ahead and gather your supplies when a storm “watch” is issued.

4. Use the Buddy System

Don’t hesitate to ask for help if you need it. By pairing up with a neighbor, you can share equipment and tools and help one another with installation. Work together to fully shutter one home at a time; that way, if you run out of time, you can both take shelter in the house that is fully protected.

Follow these tips to get the most out of your window protection system and to keep your home and family safe until the high winds have passed.

5 Flood Prevention Tips for Your Business

9/14/2020 (Permalink)

Maintaining your landscaping can also help stop flooding

Maintaining your landscaping can also help stop flooding

Follow These Five Tips To Prevent Flooding And Flood Damage

If you experience high water after a storm in Flourtown, PA, then you may need to contact storm damage restoration service. These professionals can help with cleanup and repairs, and may also be able to recommend prevention measures before the storm arrives. Here are five tips they may give you.

1. Keep Drainage Clear of Debris

One of the first steps you can take for flood prevention is to keep drainage areas clear of debris. This will help prevent water from backing up and overflowing into undesirable areas such as the room or a basement area.

2. Maintain Your Landscaping

Maintaining your landscaping can also help stop flooding. Both because removing debris can keep drainage pathways clear, and keep loose objects from being blown about by the winds and potentially damaging the building. You may also wish to bring lawn objects inside before a storm.

3. Use Flood Barriers Where Needed

If your business property is at risk for high water you may want to consider the use of a flood barrier. This should be places around doors and window wells in such a way as to redirect water flow away from the building.

4. Move At-risk Items Away from Entry Points

It's a good idea to move items that may be sensitive to water damage away from at-risk locations such as near entry points or windows. You may wish to relocate these tools temporarily to the center of the building or an upper floor until the storm is over.

5. Back Up Your Data

Just in case water does get inside it’s important to back up any electronic data. If possible use an external server. This will help prevent the loss of important files, even if the electronics themselves are damaged.

If you do experience high water after a storm, a restoration service can help. Following these five tips may help prevent flooding and flood damage to begin with. Keep any drainage clear of debris, maintain landscaping, and make use of flood barriers. It’s also a good idea to move at risk office items away from entry points and back up all your electronic data just in case.

How To Mitigate Damage to Your Roof

8/11/2020 (Permalink)

Gutters can get clogged with leaves, sticks, and dirt

Gutters can get clogged with leaves, sticks, and dirt

Preventive Measures To Implement Before a Storm Comes

When a storm hits in Lafayette Hill, PA, your roof is exposed to the elements. Heavy wind, rain, and snow can cause significant roof damage. You aren't able to completely protect your roof during a storm, but there are some preventive measures you can implement before a storm comes your way.

1. Stay Alert to Weather Reports

In the winter, it's a good idea to check the weather report every day. During tornado or hurricane season, the same approach is recommended. Since weather can change quickly, it's wise to keep abreast of weather changes all year. If you are aware of an coming storm before it hits, you will have time to make some preparations. Using a sturdy ladder with a loved one keeping it steady, climb up to the roof and inspect it thoroughly. If you find weak areas anywhere on the roof, call a storm damage restoration service right away. In the interim, cover any weak or damaged shingles with plastic tarps.

2. Trim Trees Near the House

Wind damage during a storm can be caused by trees that are situated near your house. Trees that overhang the roof are especially precarious. Loose branches can break off during strong winds and cause serious roof damage. It's a good idea to keep the trees near your home trimmed all year long, but especially before a storm hits.

3. Check the Gutters

Gutters can get clogged with leaves, sticks, and dirt. When this happens, it prevents the gutters from properly removing the water from your roof. This will eventually lead to a leaky roof. Gutters that are well-maintained will be able to keep water off your roof more effectively. Check the gutters periodically, but especially before a storm comes, and remove all of the debris.

While you can't totally eliminate the possibility of roof damage, these tips will help to mitigate any potential problems.

Can Landscaping Reduce Flood Risks?

4/28/2020 (Permalink)

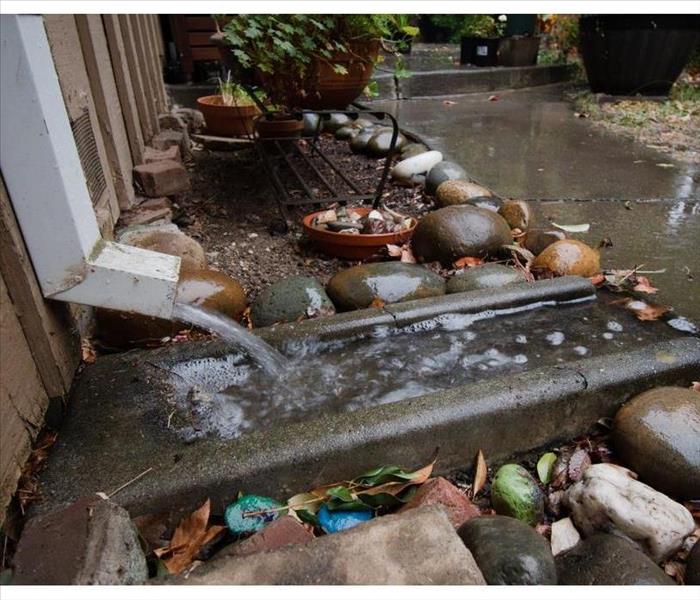

Make sure downspouts are extended to at least three feet away from your house to avoid flooding

Make sure downspouts are extended to at least three feet away from your house to avoid flooding

Ways To Minimize The Risk of Flooding

Heavy rain and severe weather pose an outside flooding risk to a residence in Wyndmoor, PA. Homeowners seeking effective flood proofing measures may need to adjust the lay of the land. The following priorities can minimize the risk of water damage.

Diverting Drainage

The roof of any residence should have functional rain drainage. A system with the following components can reduce the risk of flooding:

- Gutters

- Downspouts

- Downspout diverter

Gutters and downspouts collect rain from the roof and reduce the risk of roof damage that leads to leaks. A diverter directs water away from the base of the structure. It is important to make sure that drainage is clear and functional and that the diverter is angled properly to reduce pooling around the foundation and runoff.

Slowing Runoff

The landscape of a property should be designed for functionality as well as appearance. The most effective way to slow the rate of runoff is to improve the tilth or texture of soil. A six percent slope or six inches per 100-foot run with a layer of topsoil can be helpful for managing outside flooding. The flow of runoff can also be slowed by ground cover, such as perennial plants.

Promoting Absorption

Features such as rain gardens and swales are helpful for encouraging water to sink into the ground during and after a rain storm. Swales are depressions that may contain rocks or plants leading up to a drain. Rain gardens may be situated in a swale or on any other part of the landscape where absorption would be helpful for managing runoff or lowering flooding risks.

All of these measures can reduce the risk of outside flooding at a residence in Wyndmoor, PA. Many different types of landscaping materials and techniques are useful for floodproofing. Consult with local or regional landscaping professionals to determine the best solutions for managing runoff.

Tax Relief for Storm Damage

4/3/2020 (Permalink)

Call SERVPRO after storm damage in Flourtown, PA

Call SERVPRO after storm damage in Flourtown, PA

Tax Relief for Storm Damage

If your commercial property in Flourtown, PA, has storm damage, it may cost a lot to repair the damage, replace ruined items and restore the building to a functional state. Your flood policy likely covers a large portion of the cost of flood mitigation services, but what about the inevitable out-of-pocket costs? It is likely that you are able to write off at least some of the costs when you file your next tax return. Here are three tips to help you do so.

1. Check Disaster Declaration

Whenever there is a large-scale storm, such as a tornado or hurricane that covers a wide area of the country, the President will often declare the areas affected as disaster areas. This declaration helps business owners with part of the eligibility verification. You may also be able to file under whichever recent year gives you the best tax break. A list of federally declared disaster areas is frequently updated on the FEMA website.

2. Know Property Value

The amount of out-of-pocket expenses you are able to deduct for storm damage may depend on the value of your property. With most losses, you calculate the amount based on either the tax basis or fair market value of your building, whichever is smaller. The tax basis is usually the amount you originally paid for the property, whereas the fair market value is its current appraisal. Your tax accountant can help you navigate whether this information is needed when you are calculating your tax deductible expenses.

3. Prove Property Ownership

In order to get a tax break for damage, you must own the property. If you rent your office space, therefore, you are not eligible for this particular tax break. The burden of proof of property ownership is on the filer.

Storm damage can be expensive to repair, even if you have flood insurance. You may be able to get some tax relief to ease the financial burden.

Handling a Flooded Basement

3/11/2020 (Permalink)

If you've experienced flooding in your home, don't panic.

If you've experienced flooding in your home, don't panic.

Should you find standing water in the basement of your Whitemarsh, PA, home, you may be unsure how to handle the situation. Any time there are conditions that lead to flooding, such as severe weather or a broken pipe, you need to take action quickly to lessen the long-term damage. Here are some tips to handle a basement flood.

Safety

Cleanup

Restoration

Stay Safe

Safety is of utmost concern when you're dealing with flood conditions. Do not attempt to enter a flooded basement yourself. If you have a circuit breaker that is located away from the water, immediately shut off power to your home. If you cannot access the breaker, evacuate your home. When everybody is in a safe location, contact professionals in emergency basement cleanup and restoration. This is a crucial and time-sensitive step to ensure that your home can be properly dried and restored.

Clean Up

If you can safely stay in your home, ensure that all electronic devices are powered off, and start moving wet objects to a dry area. Carpets, rugs, couches, and other porous items need to be removed from standing water and thoroughly dried and sanitized. Professional services are the best way to return your home and your belongings to a pre-disaster state. Recovery from flooding takes time and work, but experts can make the process easier.

Repair and Restore

Since water can enter your home in several ways, it's imperative to find the source of the water in order to prevent additional floods. If the flood was caused by a sewer backup or a burst pipe, contact experts to help with pipe repair. If the flood was caused by severe weather, your home probably has cracks or holes in the walls that allow the water to come in. Creating proper drainage and installing or repairing basement waterproofing may be necessary.

If you've experienced flooding in your home, don't panic. Call professionals as soon as possible to help you get back on your feet.

Safeguard Against Storm Damage

3/10/2020 (Permalink)

Exterior maintenance should be a priority for property owners.

Exterior maintenance should be a priority for property owners.

Safeguard Against Storm Damage

Regardless of the size of your property, or properties, in Whitemarsh, PA, regular maintenance and inspections can help structures better weather the weather. Along with inspecting the inside for issues including plumbing, water damage and HVAC operations, keeping a building maintained requires exterior maintenance. Property owners should ensure a regular building inspection is on the to-do list.

Below are four key areas to inspect to guard against storms.

Roofs

Hail, high winds and precipitation can do a number on roofs. Although built to last, even a small point of weakness can quickly turn into a major repair.

Check the following during a roof inspection:

1. Ensure shingles tightly attached and fit together, show no signs of tearing or crack and that none are missing.

2. Verify that roof sheathing is firmly nailed down.

3. Check skylights, pipes, HVAC units or other equipment is properly affixed.

4. Inspect gutters for any clogs or gaps.

5. Attics and ceilings should also be inspected for signs of water damage, rot or leaks.

Doors and Windows

Entry points are also key items for exterior maintenance inspections. Cracks or crevices in window or door seals can create an inviting opening for the storm to come inside. Along with ensuring proper, tight installation, upgrading to triple-hinged doors and wind-resistant windows is an option to beef up storm protection.

Foundations

Any cracks or missing pieces of foundation can gradually lead to growing water damage problems, requiring a water remediation expert to restore and waterproof the building. Along with obvious signs in the foundation itself, inspect walls, floors, support beams and windows for signs of air leaks or water damage.

Landscaping

The right landscaping can help keep water from building up around the foundation. Check that there is a proper slope away from the building. Also, trees may add an appealing aesthetic, but they need to be maintained to keep branches from damaging the roof or crashing into windows.

Exterior maintenance should be a priority for property owners. A quick check of the above areas can help you find problems before they turn into bigger ones.

What Is the Difference Between Flood Damage and Water Damage?

3/3/2020 (Permalink)

Water is essential to life; however, it is also extremely powerful.

Water is essential to life; however, it is also extremely powerful.

Water is essential to life; however, it is also extremely powerful. When a storm strikes, should you file a claim for flood damage or water damage? Insurance companies do not treat these claims equally. There are a few common sources of water damage:

Broken pipes

Damaged washing machines

Busted water mains

Clogged drains

On the other hand, flash floods can also cause significant damage to a warehouse or office building. What determines the type of claim you should file? There are a few major differences between the claims that you should note.

Flood Definition

A flood is defined by the Federal Emergency Management Agency as a temporary condition that causes partial or complete inundation of at least two acres of land that is typically dry. For example, floods can be caused by an overflow of tidal or inland waters. Other floods might be caused by the collapse of land that sits near the shore. Finally, severe storm damage can also result from a flood.

If your building in Whitemarsh, PA, has suffered damage from any of the sources described above, you are probably dealing with flood damage. Therefore, you should file a flood claim.

Water Damage Definition

The difference between typical water claims and damage due to flooding is dependent on where the water originates. Routine water damage comes from inside the building. This includes ruptured pipes, overflowing toilets, and broken washing machines. On the other hand, flood claims tend to start outside the home. They generally impact two or more properties. Therefore, if you are the only one calling emergency restoration services in Whitemarsh, PA, you are probably dealing with a standard water claim.

Flood Protection

Flood damage can be severe no matter where the issue is located. Therefore, it is important for you to know who to call in the event of an emergency, so you can return to business as normal as quickly as possible.

How To Dry Out a Flooded Basement

2/29/2020 (Permalink)

A basement flood can be an inconvenience.

A basement flood can be an inconvenience.

Because they are located underground, basements are prone to flooding. Many homeowners install sump pumps to help remove excess water, but if you have a major basement flood, you may need to follow these steps to dry it out.

1. Take Safety Precautions

Standing water in a flooded basement can be an electrocution danger, so one of the first things you should do is shut off the electrical power to your basement. Floodwaters can sometimes be contaminated by sewage and other toxic materials. You may wish to contact a professional flood remediation company in Whitemarsh, PA, that will have access to the proper protective gear and training needed to remove contaminated water.

2. Locate the Source of the Water

If your basement flood has been caused by floodwaters, you will likely need to wait for floodwaters to recede before attempting to remove the water. If the water is coming from somewhere inside your homes, such as a burst pipe or an overflowing toilet, you will need to shut off the water before you can begin drying your basement out.

3. Remove the Water

Before you do any work, you may want to take photographs of the damage, so that you will have them in case you need to use your flood insurance coverage. You may be able to clean up a smaller flood with a wet/dry vacuum. For larger floods, you will likely need to use a submersible pump. Gas-powered pumps should be avoided, due to the risk of fumes.

A basement flood can be an inconvenience, but if you follow the proper steps you can dry it out and reduce the amount of potential damage to your property. Depending upon the level of severity of the flooding, you may be able to do the work yourself, but for more severe floods it can be a good idea to hire a professional.

The ins and outs of Commercial Storm Insurance

2/3/2020 (Permalink)

Examine your business and determine whether it makes sense to purchase storm insurance.

Examine your business and determine whether it makes sense to purchase storm insurance.

Any wise business owner understands the importance of having insurance coverage. However, some people in this position forget about commercial storm insurance. If your company operates in an area in Whitemarsh, PA, where floods and other severe are common, it's important to protect your business and your employees. Before you speak with an agent and purchase a policy, it's helpful to understand how it works, what it covers and what it doesn't cover.

Why Get It?

Some people may wonder why they should spend the money to purchase this insurance coverage. After all, isn't commercial property insurance enough? This policy gives you financial protection in the following ways:

It can replace items and equipment you lost in a storm.

It can replace building materials and structural components lost in a storm.

It can compensate your business for the cessation of operations.

What Traditional Property Insurance Covers

Property insurance is important because it protects your business from having to pay to repair damage sustained by accidents or vandalism. For example, if heavy winds or torrential rain ruins windows or siding, the property coverage should take effect. Unexpected failures from appliances, systems and the building structure should also fall within this coverage.

When Storm Insurance Steps In

Regular property insurance plans won't cover damage from large storms such as hurricanes and tornadoes. Also, if a sewer backup or overflowing river brings water into your building, your property insurance policy won't pay for a flood remediation specialist to do the cleanup. However, supplemental storm coverage will protect your business when these incidents occur.

When There's No Coverage

If there is damage in your building because you failed to maintain the plumbing, roof or HVAC systems, neither insurance coverage will accept your claim. Also, if you deliberately cause a flood or other damage to the building, you will not get any insurance help.

Examine your business and determine whether it makes sense to purchase storm insurance. You can find a plan that suits your needs.

Making Sure You Are Covered for a Commercial Flood

1/29/2020 (Permalink)

Flood damage is often quite costly, and it’s important to understand your coverage options for various scenarios.

Flood damage is often quite costly, and it’s important to understand your coverage options for various scenarios.

Weather events that cause flooding are occurring with increasing frequency. If your Whitemarsh, PA, location is at risk for flooding or your property has been water damaged, this discussion about commercial insurance coverage may answer some of your questions. Will your business insurance cover flood cleanup and restoration at your commercial facility? The answer is, it depends. Most types of commercial flood damage are excluded from your conventional insurance policy but would be covered under a special flood insurance policy.

Government-Issued Insurance

Commercial flood policies are purchased separately from the government’s insurance program. The source of the flooding determines which type of coverage applies. If any of the following caused your business to flood, a government insurance policy would generally cover you:

Overflowing rivers or streams

Blocked storm drainage systems

Storm surge from hurricanes, severe storms or snowmelt

Broken dams or levees

Broken municipal water mains

You may be required to purchase a government-issued policy if your property is in a high flood-risk area. Your insurance agent will generally be able to help you evaluate and purchase flood insurance.

Commercial Insurance

Storm-related water damage will be covered by your conventional insurance policy if the damage came from above ground level. For instance, if hail or a tree branch breaks your skylight and heavy rain causes damage to your property, your commercial policy would be responsible. Most types of internal water damage, such as broken pipes and leaking appliances, would also be eligible for coverage by your business policy.

Flood Risk

Even if your property is not in a designated high-risk flood area, you could still bear some flood risk and benefit from purchasing flood coverage. If you are located in an area known for heavy snowmelt or significant rainstorms, you bear some risk. Water can back up behind a clogged storm drain and quickly lead to rising floodwaters.

Flood damage is often quite costly, and it’s important to understand your coverage options for various scenarios. Then you can decide whether to pursue government-issued insurance, rely on your commercial insurance policy, or purchase additional flood insurance.

Winter Storm Harper

1/18/2019 (Permalink)

Winter Storm Harper is predicted to pile on snow and ice from Friday well into the weekend to areas that have, up until now, only experienced some mild winter weather, according to Weather.com.

Winter Storm Harper’s trajectory is still uncertain at this point, however, predictions have the storm moving through the central states and into the Northeast, bringing heavy snow to the Plains, New England, Pennsylvania and New York State in particular.

There will also be a small, weak weather system on Wednesday that will bring some rain and light snow to the Midwest and Northwest, according to Weather.com. But after this system clears, Winter Storm Harper will bring much more extreme conditions.

Here’s what to expect, according to Weather.com:

On Thursday, Harper will bring snow into the Rockies, Sierras and Cascades, then spread into the Northern Plains by nighttime. On Friday, the Rockies will continue to have snow, but so will the Plains — possibly even escalating to blizzard conditions.

By Friday night, the lower Great Lakes, Kansas, parts of Oklahoma and the Texas Panhandle may see some snow, or possibly a snow/rain mix, Weather.com reported. Sleet and freezing rain should be expected for northern Missouri and southern Illinois.

On Saturday, the Northeast gets its fair share of the storm. Heavy snow will be falling in some areas of the Plains still, plus the Midwest and Northeast. People in the Midwest should hunker down for possible blizzard conditions, as strong winds may also be present, said Weather.com.

Be sure to keep an eye on your local weather to ensure a safe weekend!

Content by: https://www.travelandleisure.com/travel-news/winter-storm-harper-heavy-snow-northeast

Hurricane Preparedness in Our Area

5/30/2018 (Permalink)

National Hurricane Preparedness Week May 6-12

National Hurricane Preparedness Week May 6-12

Hurricane Preparedness - Be Ready

While we are not located close enough to the ocean to feel a hurricane’s full effect on a regular basis, hurricanes always pose a wind and water damage threat to our property. Two keys to weather safety are to PREPARE for the risks and to ACT on those preparations when alerted by emergency officials. According to the FEMA, we can prepare for a hurricane by following this four stage guide:

Gather Information

Know if you live in an evacuation area. Assess your risks and know your home's vulnerability to storm surge, flooding and wind. Understand National Weather Service forecast products and especially the meaning of NWS watches and warnings. Contact your local National Weather Service office and local government/emergency management office. Find out what type of emergencies could occur and how you should respond.

Contacts

Communications is important during a weather emergency. Keep a list of contact information for these resources:

Emergency Management Offices, County Law Enforcement, County Public Safety Fire/Rescue, State, County and City/Town Government, Local Hospitals, Local Utilities, Local American Red Cross, , Local TV Stations, Local Radio Stations, Your Property Insurance Agent

Plan & Take Action

Everyone needs to be prepared for the unexpected. Your friends and family may not be together when disaster strikes. How will you find each other? Will you know if your children or parents are safe? You may have to evacuate or be confined to your home. What will you do if water, gas, electricity or phone services are shut off?

Supplies Kit

Put together a basic disaster supplies kit and consider storage locations for different situations. Help community members do the same.

Emergency Plans

Develop and document plans for your specific risks. Protect yourself and family with a Family Emergency Plan. Be sure to plan for locations away from home. Pet owners should have plans to care for their animals. The Centers for Disease Control & Prevention offer information on animal health impacts in evacuation shelters.

Evacuation

Review the FEMA Evacuation Guidelines to allow for enough time to pack and inform friends and family if you need to leave your home. FOLLOW instructions issued by local officials. Leave immediately if ordered!

Consider your protection options to decide whether to stay or evacuate your home if you are not ordered to evacuate.

When waiting out a storm be careful, the danger may not be over yet. Be alert for Tornadoes, as they are often spawned by hurricanes. The calm "eye" of the storm – it may seem like the storm is over, but after the eye passes, the winds will change direction and quickly return to hurricane force.

Recover

Wait until an area is declared safe before returning home. Remember that recovering from a disaster is usually a gradual process.

Resources

Here are some additional resources for Hurricane Preparedness

- Refer to the Federal Emergency Management Agency's (FEMA) gov/hurricanes for comprehensive information on hurricane preparedness at home and in your community.

24/7 Emergency Service

24/7 Emergency Service